Trade synthetic financial instruments that mirror real-world assets without full ownership.

Why Choose Synthetic Trading with Accuindex

Accuindex is your trusted partner in accessing innovative trading solutions. As a fully regulated brokerage, we provide traders with the tools, resources, and support to explore synthetic markets with confidence.

What Is Synthetic Trading?

Synthetic trading is a financial strategy that allows traders to replicate the performance of traditional investments using derivatives such as options, futures, and Contracts for Difference (CFDs). It uses synthetic instruments, which are engineered to mimic the behavior of real assets like stocks, commodities, or currencies. This allows for increased flexibility, lower capital requirements, and more strategic opportunities.

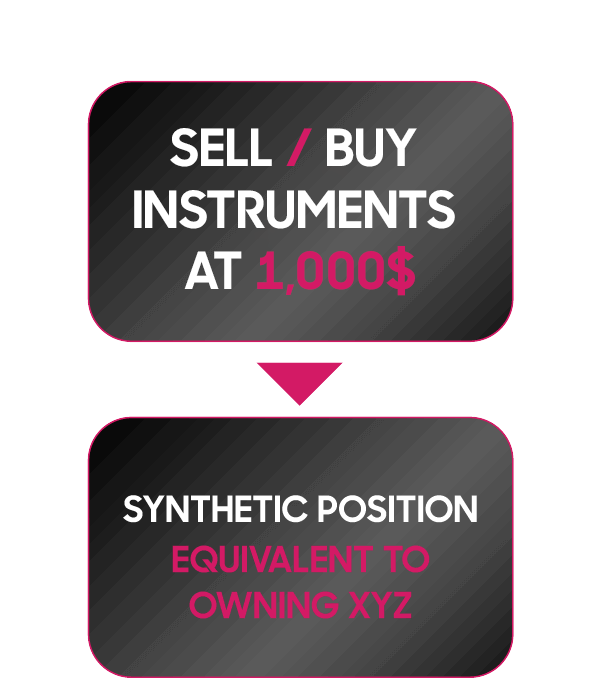

Example in Action:

If shares of XYZ are priced at $1,000, instead of purchasing them outright, you can create a synthetic position using derivative contracts that track its price movements. This allows you to gain exposure to the asset's performance without needing to own the underlying instrument, optimizing capital efficiency.

Key Advantages.

Lower Capital Requirement

Gain market exposure without committing large amounts of funds.

Strategic Flexibility

Adjust your strategies based on market conditions and risk tolerance.

Improved Risk Management

Use synthetic positions to manage risk exposure and protect against market downturns.

Why Trade Synthetics with Accuindex?

Comprehensive Trading Tools

Access advanced platforms compatible with desktop, mobile, and web.

Regulated and Secure Environment

Trade confidently under a regulated and transparent framework.

Wide Range of Instruments

Trade up to 16 CFDs with competitive spreads.

Expert Support

24/5 dedicated support to guide your trading journey.

Frequently Asked Questions About Synthetic Accounts

Is synthetic trading profitable?

Synthetic trading offers the potential for high profits, especially in volatile markets. However, like any trading strategy, it carries risks, including amplified losses if not managed properly.

Why buy synthetic instruments?

Synthetic instruments allow traders to replicate ownership benefits with reduced risk and capital. They are ideal for managing exposure and leveraging strategic flexibility.

What types of synthetic strategies are available?

Buy and Sell Options

Have more questions? Contact our support team today!